Mastering the Art of Diamond Valuation: Tips for Brokers

In the glittering world of gemstones, diamonds hold a place of distinction, not just for their breathtaking beauty but also for their intricate valuation process. Understanding the nuances of diamond valuation is crucial for brokers aiming to navigate the market successfully.

In the glittering world of gemstones, diamonds hold a place of distinction, not just for their breathtaking beauty but also for their intricate valuation process. Understanding the nuances of diamond valuation is crucial for brokers aiming to navigate the market successfully. This comprehensive guide delves into the art of diamond valuation, equipping you with the knowledge to assess diamonds accurately and confidently.

The 4 C's of Diamonds: A Foundation for Valuation

At the heart of diamond valuation lie the 4 C's: Cut, Color, Clarity, and Carat Weight. These criteria form the cornerstone of assessing a diamond's quality and, consequently, its market value.

Cut: The cut of a diamond doesn't just refer to its shape but also to how well the diamond has been cut and polished. A well-cut diamond reflects light beautifully, enhancing its brilliance and fire. The quality of the cut significantly impacts a diamond's value.

Colour: Diamonds are graded on a colour scale from D (colourless) to Z (light colour). The closer a diamond is to being colourless, the higher its value. Colourless diamonds are rare and sought after for their pristine beauty.

Clarity: Clarity measures the presence of inclusions and blemishes in a diamond. The scale ranges from Flawless (FL) to Included (I). Diamonds with higher clarity grades have fewer visible inclusions, making them more valuable.

Carat Weight: Carat weight is the measure of a diamond's size. While larger diamonds are rarer and more valuable, the carat weight must be balanced with the other C's to determine the overall value of a diamond.

Determining the Value of a Diamond

Valuing a diamond extends beyond the 4 C's. Brokers must consider additional factors such as market demand, rarity, and provenance. The valuation process often begins with a certified grading report from reputable institutions like the GIA or AGS, which provides an unbiased assessment of the diamond's characteristics.

To accurately determine a diamond's value, brokers should also stay informed about current market trends and consumer preferences. For example, certain diamond shapes or colours may become more popular, affecting their market value.

Evaluating Diamonds: Beyond the Basics

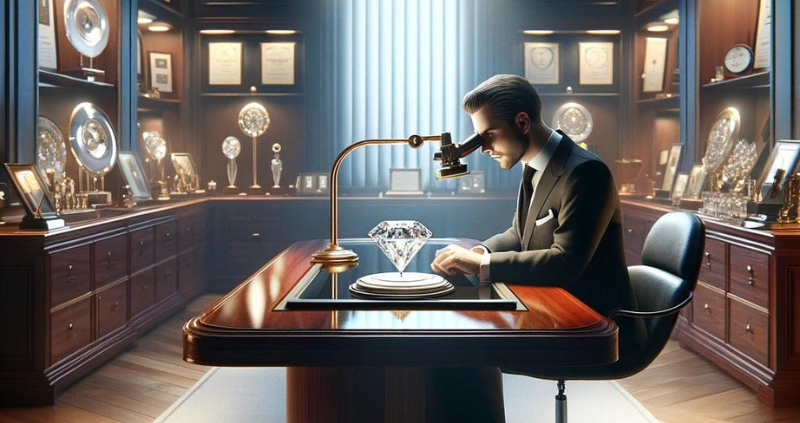

Advanced diamond evaluation involves a meticulous inspection process, utilizing specialized tools such as loupes, microscopes, and spectrophotometers to examine a diamond's physical and optical properties. Brokers should also consider the diamond's fluorescence, symmetry, and polish, as these factors can influence its overall appearance and desirability.

Certification from a reputable lab provides a comprehensive report on these characteristics, offering peace of mind to both brokers and buyers. However, nothing replaces the importance of hands-on experience and expertise in diamond valuation. Continuous education and practical experience enable brokers to make informed decisions and offer expert advice to their clients.

Mastering the art of diamond valuation is a complex but rewarding endeavour. By understanding the 4 C's, keeping abreast of market trends, and employing thorough evaluation techniques, brokers can offer invaluable advice and services to their clients. The key to success lies in continuous learning and staying equipped with the right tools and knowledge to navigate the ever-evolving landscape of the diamond industry.

"GA Demands" offers expert insights into diamond valuation for brokers. Our guide, "Mastering the Art of Diamond Valuation," covers the 4 C's, market trends, and evaluation techniques, helping brokers excel in gemstone appraisal. Join us to enhance your expertise in diamond valuation.